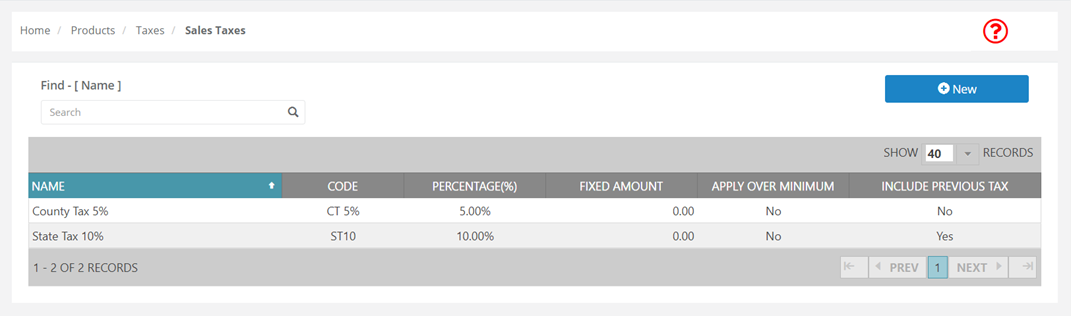

Sales Taxes

Use the Sales Taxes menu option to define sales tax codes and to enter details regarding any sales taxes you may wish to apply at your store.

You can specify each sales tax as a percentage of the purchased amount.

You can also specify if tax amounts from other sales tax codes should be included in the tax computation.

Some locations have a maximum amount on which tax may be assessed on a particular item.

If this is the case, you should enter the maximum tax amount in the Maximum Taxable Amount field.

Whenever you define a sales tax code, the tax collected for each sales tax is also tracked and available for reporting.

When you click Sales Taxes, the Sales Taxes window appears. Click New to create a new sales tax code.

|

Fields |

Description |

|

Name |

The name assigned to the Sales Tax (tax code). |

|

Code |

The number by which the sales tax can be referenced. |

|

Minimum taxable amount |

If there is a minimum limit on the tax amount applied to an item, enter the limit in this field. |

|

Maximum taxable amount |

If there is a maximum limit on the tax amount applied to an item, enter the limit in this field. |

|

Sales Tax Rate (%) |

If the sales tax is computed as a percentage of the selling price, enter the percent tax in this field. |

|

Fixed Amount |

If the tax is a fixed amount regardless of the purchase amount, enter the tax amount in this field. |

|

Only apply tax to portion over minimum taxable amount |

If selected, the customer would pay the tax only on the amount that exceeded the minimum taxable amount. For example, assume your minimum taxable amount was $100 and your customer bought an item for $110. If this option is selected, pays tax only on the $10. If the option is cleared, pays tax on the entire $110 |

|

Include any previous sales taxes in calculation |

If selected, the tax amount for this sales tax is computed based on the item price and taxes resulting from previous sales tax codes. The sales tax order is determined in the Item Taxes menu option. |

On completion, click on the Save button.